LIBOR was discontinued for most currencies at the end of 2021, with only USD LIBOR set to be discontinued in 2023.1Various forms of LIBOR across currencies, including GBP LIBOR, and tenors have already been discontinued, with the publication of USD LIBOR set to end in June 2023.1 LIBOR has been widely accepted as a reference by tribunals in their decisions on pre-award interest rates.2Tiago Duarte-Silva and Swati Kanoria, IA Insights: The importance of interest in arbitral awards, CRA INSIGHTS, Feb. 9, 2022, https://www.crai.com/insights-events/publications/ia-insights-the-importance-of-interest-in-arbitral-awards/2 The question now is what will replace it as the new benchmark lending rate. The Secured Overnight Financing Rate (SOFR) has emerged as a leading benchmark in financial markets.

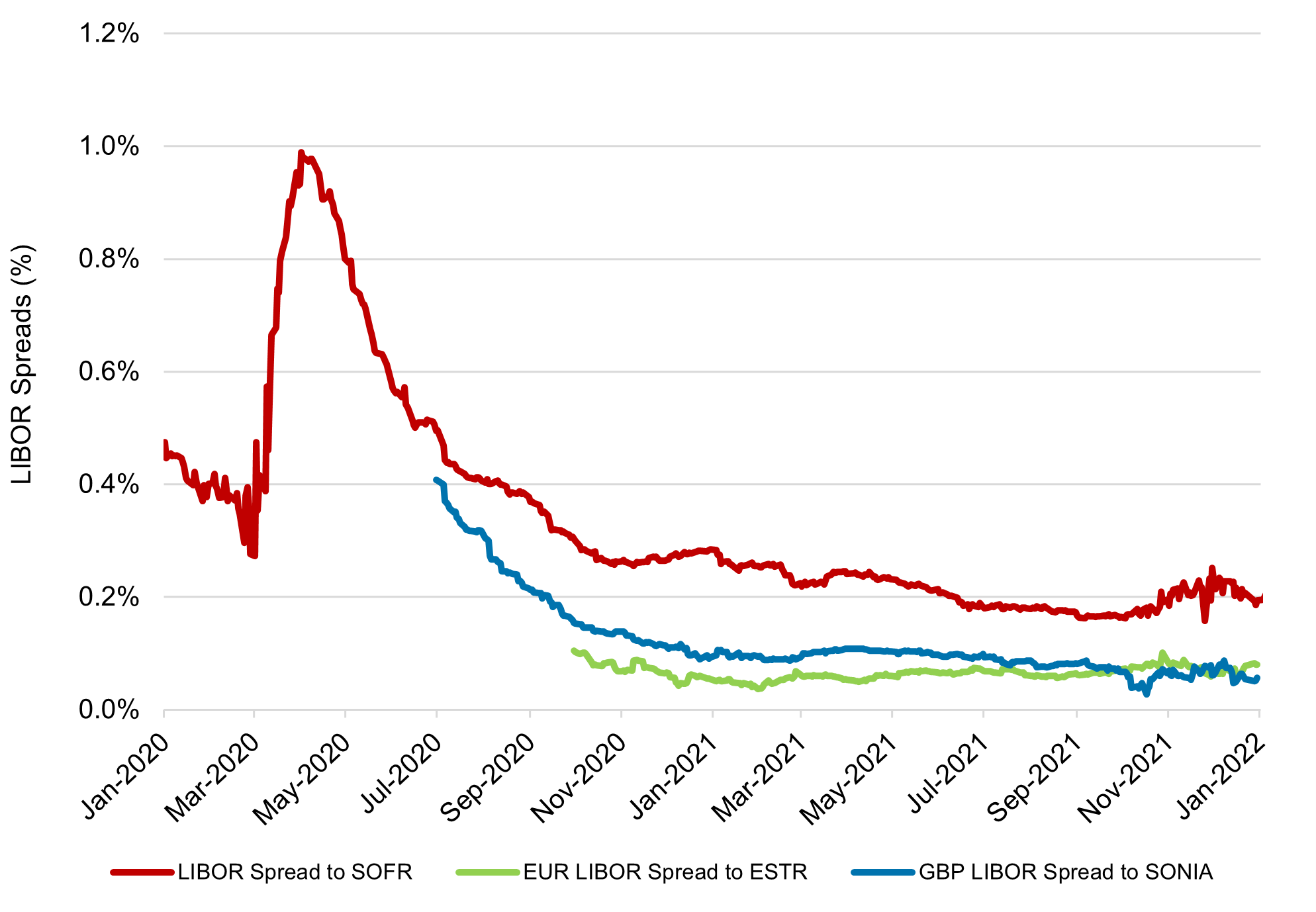

SOFR shares considerable similarities with LIBOR. It is based on the rates that large financial institutions pay to one another for overnight loans.3Secured Overnight Financing Rate Data, FEDERAL RESERVE BANK OF NEW YORK, https://www.newyorkfed.org/markets/reference-rates/sofr.3 Because LIBOR was an unsecured rate and SOFR is secured, SOFR is associated with lower risk than LIBOR. This fact is illustrated by, for example, SOFR rates being lower than LIBOR rates in both the overnight and 12-month tenors. Figure 1 below shows LIBOR’s spread over SOFR for the 12-month tenor.4Note that SOFR is an overnight rate by definition; 12-month-term SOFR is based on swaps.4 Since 2020, SOFR has been lower than LIBOR by an average of 26 basis points (i.e., 0.26 percentage points).5Median LIBOR spread over SOFR, 12-month tenor, January 2020–February 2022. Data from Eikon and Intercontinental Exchange (ICE).5

Figure 1: LIBOR spread to SOFR, 12M tenor6Data from Eikon and Intercontinental Exchange (ICE).6

Although SOFR and LIBOR are similar, it is important that tribunals not simply move the goalposts by changing pre-award interest rates such as LIBOR+2.00% to SOFR+2.26%, for example. True borrowing costs vary with the borrower’s risk and with market conditions.7Aaron Dolgoff and Tiago Duarte-Silva, Pre-award interest: Is LIBOR+2% a reasonable commercial rate?, CRA INSIGHTS, June 14, 2022, https://www.crai.com/insights-events/publications/pre-award-interest-is-libor2-a-reasonable-commercial-rate/.7 The same principles apply to SOFR.

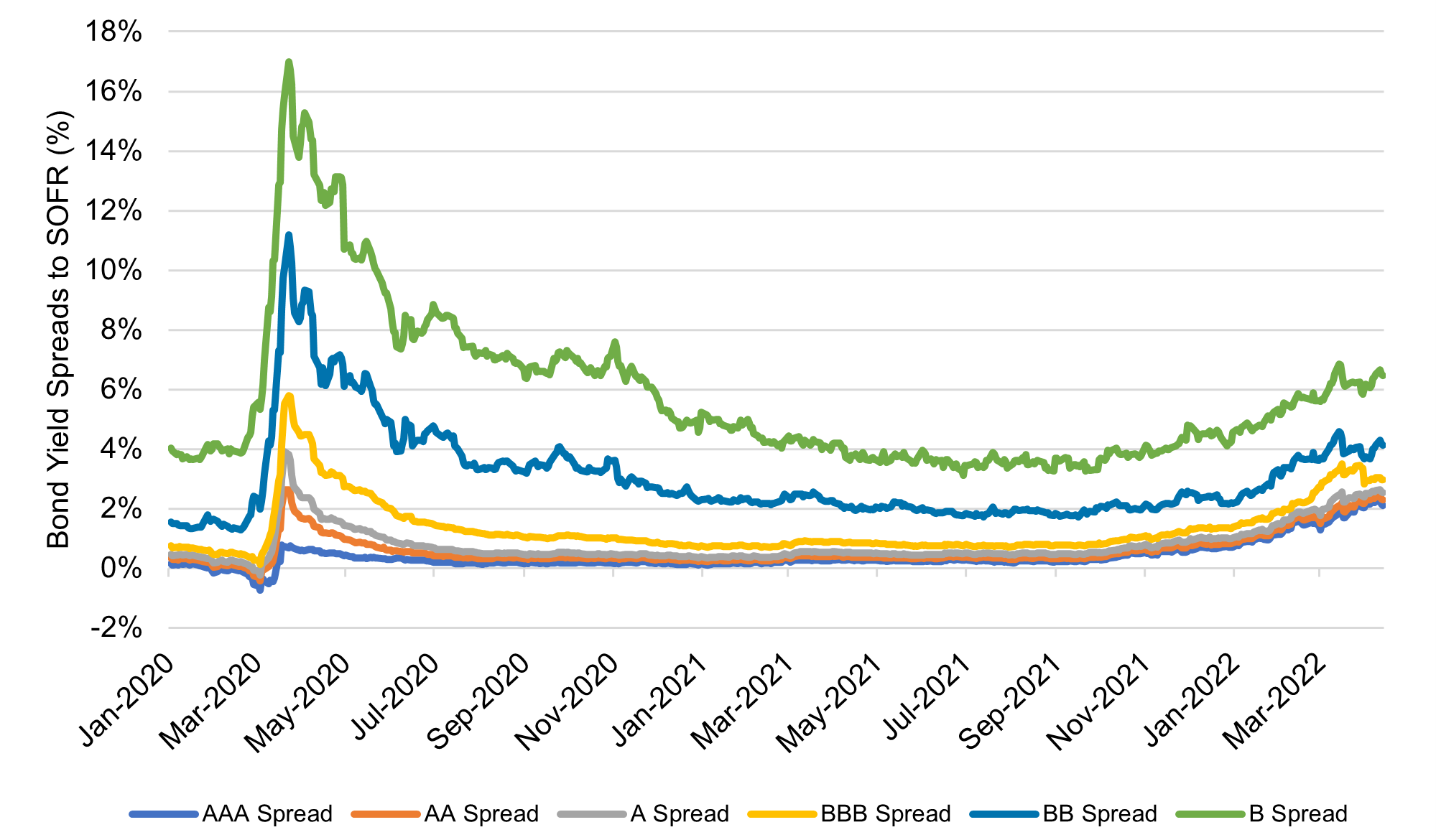

Figure 2 below shows bond yield spreads to SOFR since 2020, (i.e., how much higher than SOFR were the rates on debts of different risks/ratings). For example, the green line shows rates on debts rated B (within the junk debt category), whereas the orange line shows rates on debts rated AA.

Figure 2: Bond yield spreads to overnight SOFR across credit ratings8Bond yield ratings based on indices of one-to-three-year corporate bond yields at each credit rating. Data from Eikon.8

It is too early to observe a full business or credit cycle of how these spreads vary over time; nevertheless, it is clear that SOFR plus a standardized spread (e.g., 2.00% or even 2.26%) does not capture the variety of commercially reasonable rates. For example, AA-rated debts have had spreads between 42 basis points below and 263 basis points above SOFR (i.e., -0.42 to 2.63 percentage points), and B-rated debts’ spreads over SOFR have always been at least 300 basis points (i.e., 3.0 percentage points).

It is also clear that SOFR plus a standardized spread does not capture changing market conditions. For example, the spread on B-rated debts has varied more than 1,387 basis points since 2020, (i.e., 13.87 percentage points).

The discontinuation of LIBOR has implications for lending rates in foreign currencies as well. The Euro Short-Term Rate (ESTR) has replaced EUR LIBOR, while the Sterling Overnight Index Average (SONIA) has replaced GBP LIBOR.9LIBOR Reforms, HSBC, https://www.gbm.hsbc.com/financial-regulation/ibor.9 Like LIBOR, they do little to capture risk profiles and market conditions, two essential components of interest rates.

Figure 3 below shows LIBOR spreads to its replacements across currencies. It shows that LIBOR rates are higher than their currency equivalent replacement benchmarks, indicating that these new benchmarks represent lower-risk lending rates–they are not the same as LIBOR.

Figure 3: LIBOR spreads to SOFR, SONIA, and ESTR, 12-month tenor10Data from www.global-rates.com, Eikon, European Central Bank (ECB), and Intercontinental Exchange (ICE). ECB began publishing 12-month ESTR in October of 2020. 12-month SONIA not available on Eikon prior to July of 2020. 10

As these transitions take place, it will be important to consider that the LIBOR replacements should not be accepted as perfect substitutes for LIBOR when it comes to selecting rates for pre-award interest. It will be just as important to realize that, like LIBOR, these replacements will do little to account for changing market conditions and risk profiles.